In case where the legal spouse is no more living after the death of a male/ female officer, who was serving in public service, to grant entitlement to widows/ widowers pension or the spouse has married again, the orphans’ pension is granted to the unemployed legal children, who are below the age of 26 years.

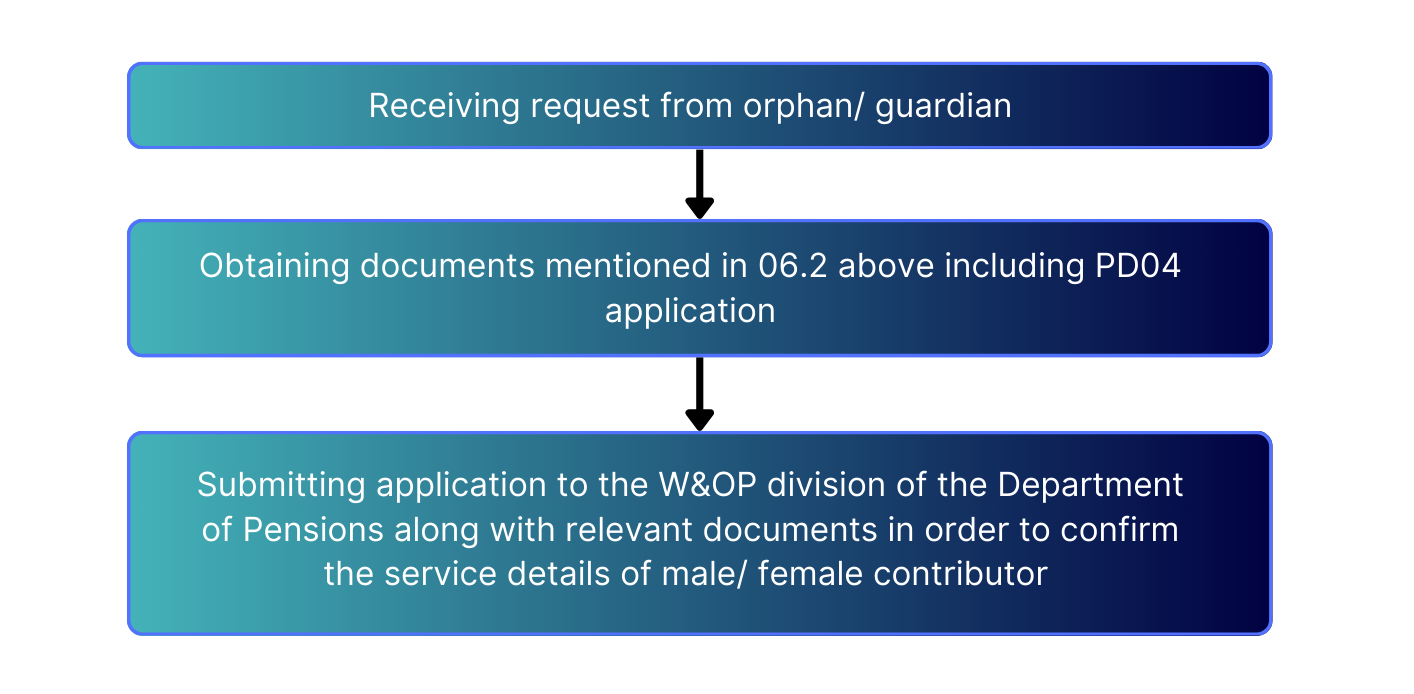

Methodology

- Payment of orphans’ pension to a minor below the age of 18 years, who is entitled to an orphans’ pension, should be made under the custody of a guardian. For this purpose, the recommendation should be given by the Divisional Secretary depending on the observation of the Grama Niladhari of the area as to whether the guardian is appropriate to be the guardian of the child and whether he/ she is capable to ensure proper education, nutrition, and health facilities to the child. For the payment of pension under such guardianship, approval of the Director General of Pensions should be obtained. It is required to enter in to an agreement by the Guardian and the Director General of Pensions as per Pensions Circular No. 07/2020 and In case where it is revealed that the appointed guardian neglects therefore the Divisional Secretary of the area should enter in to agreement on behalf of the Director General of Pensions.

- In case where it is revealed that the appointed guardian does not provide education, nutrition and health facilities to the child properly, the Divisional Secretary should with immediate effect appoint a new guardian after making a formal inquiry and then approval of the DOP should also be obtained for such appointment.

- When the orphan reaches the age of 18 years, child should be removed from the guardianship and then the payment of pension should strictly be commenced in the name of the orphan and further action should be taken to terminate the payment of orphans’ pension on completion of the age of 26 years or having an employment, whichever occurs first. Here, the pension is credited to an individual savings account operated in the name of the orphan. Further, for the purpose of the employment of the orphan, following matters in section 5 of the Pension Circular No. 01/99 are applicable.

As per the amendment made to the Act, the children of the age of 21 to 26 years are entitled to the pension, until they are unemployed. When determining the employment of an applicant for orphans’ pension, attention should be paid to the following matters.- A pensionable employment in the public service,

- An employment with the membership of a certain employees provident fund,

- Those who go abroad for foreign employment,

- Those who pay income tax under Income Tax Act,

- An owner of a business/ property, which incur an adequate income for living.”

- When this orphans’ pension is paid, the marital status of orphans will not be considered. (Section 4 of Pension Circular No. 13/2010)

- When an entitlement is made to an orphans’ pension, which has been commenced under the guardianship for minors below the age of 18 years, the pension in arrears paid as a lump sum amount, if any, should be deposited in a savings account of a state bank for the wellbeing of the child. Further, an amount given below, which is paid for the guardianship, (Individual savings account of the guardian at state/ private bank) should be directed to the account of the child as deposits. It should be deposited in the following manner,

- Pension = a part of 1/5 up to Rs. 20,000.00,

- Pension = a part of ¼ up to Rs. 20,001.00 from 35,000.00,

- Pension = a part of 1/3 if it is more than Rs. 35,000.00

- The children adopted by a public officer before withdrawing from membership of W&OP scheme should have the entitlement to enjoy benefits of W&OP scheme. For this purpose, section 33 of the main enactment has been revised in the following manner by section 14 of Widows’ and Orphans’ pensions Fund (Amendment) Act No 44 of 1981.

- 14 Section 33 of the principal enactment is hereby amended as follows: (a) by the renumbering of that section as subsection (1) of section 33 ; (b) by the addition, at the end of that subsection, of the following new subsections: " (2) A child adopted under the [Cap. 76] provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married public officer while he is a contributor shall, subject to the provisions of subsection (3) and subsection (4), be treated as a child of the adopter and accordingly such child shall be entitled to a pension under this Ordinance in like manner and to the like amount as a child of such public officer. (3) A child adopted under the [Cap. 76] provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married public officer while he is a contributor shall be entitled to a pension under this Ordinance unless the Director has reason to believe that there was no genuine desire to adopt the child and that the adoption was merely one of convenience: (c) by the substitution, for the marginal note to that section, of the following new marginal note “Pension for the children and adopted children.”.

- Provisions have been made in the following manner on granting entitlement to a child adopted by a female officer to the benefits of W&OP scheme by sub section 17 (2) and (3) of Widowers’ and Orphans’ Pensions Act No. 24 of 1983

(2) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married contributor while she is a contributor shall, subject to the provisions of subsection (3), be treated as a child of such contributor and accordingly, such child shall be entitled to a pension under this Act in like manner and to the like amount as a child of such contributor. (3) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating, to the adoption of children by a married contributor while she is a contributor shall be entitled to a pension under this Act unless the Director has reason to believe was no genuine desire, on the part, of such adopt the child and that the adoption was merely one of convenience: Provided, however, that the Director may authorize the award of a pension to such child if such child does not have an independent source of livelihood and if the Director considers that such award is just and equitable in all the circumstances of the case.

(2) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating to the adoption of children by a married contributor while she is a contributor shall, subject to the provisions of subsection (3), be treated as a child of such contributor and accordingly, such child shall be entitled to a pension under this Act in like manner and to the like amount as a child of such contributor.

(3) A child adopted under the provisions of the Adoption of Children Ordinance or any other law relating, to the adoption of children by a married contributor while she is a contributor shall be entitled to a pension under this Act unless the Director has reason to believe was no genuine desire, on the part, of such adopt the child and that the adoption was merely one of convenience:

Provided, however, that the Director may authorize the award of a pension to such child if such child does not have an independent source of livelihood and if the Director considers that such award is just and equitable in all the circumstances of the case

Documents required for the purpose

- PD 4 application

When submitting PD4 application, a suitable guardian, who is capable to ensure proper nutrition, education and protection to the orphans below the age of 18 years, should be appointed and the application should be submitted along with the guardian’s recommendation. For the orphans over the age of 18 years, PD$ applications should be submitted separately. In case of a person demised whilst in service, application should be submitted along with the recommendation of the Head of Institute and Grama Niladhari and in case of a death of a person, who demised whilst receiving pension, application should be submitted along with the recommendation of the Divisional Secretary and Grama Niladhari. - Death certificate of the contributor - First copies obtained from Additional District/ District Registrar

- Birth certificate of the contributor - First copies obtained from Additional District/ District Registrar

- Birth certificate of the spouse - First copies obtained from Additional District/ District Registrar

- Marriage certificate

- Certified copy of the N I C of the contributor *

- Certified copy of the N I C of the spouse*

- Certified copies of the bank pass book of orphan and guardian *

- A proper confirmation on the difference in the name of contributor, if any

- An affidavit or proper legal documents to confirm the differences in the name of spouse/ orphans, if any

- Following documents on the previous marriages of contributor or spouse, if any

- Marriage certificates

- Divorce certificates to prove that such marriages have come to end (For Kandyan marriages)

- Absolute order of the divorce

- Originals of death certificate

- Birth certificates and bank details of the children of the contributor's previous marriages, who are unemployed and below the age of 26 years

*To be certified by Grama Niladhari.

Role of the institution in the application process

- In case of a remarriage/ death of a person, who is receiving widow'/ widowers' pension, the application should be submitted by the relevant Divisional Secretariat and the applications of those, whose widow'/ widowers' pension payment has not been commenced, (Due to the remarriage or death of widow/ widower before commencing the payment of widows'/ widowers' pension)should be submitted to the W&OP division of the Department of Pension by the institute, where the male/female contributor served for the last time

Acts, Ordinances and Circulars applied

- Widows’ and Orphans’ Pension Fund Ordinance No 01 of 1898

- Widowers’ and Orphans’ Pensions Act No. 24 of 1983

- Widows’ and Orphans’ (Amendment) Act No. 57 of 1998

- Widows’ and Orphans’ Pension Fund (Amendment) Act No.08 of 2010

- Widowers’ and Orphans’ Pensions (Amendment) Act No.09 of 2010

- Pension Circular No. 01/99

- Pension Circular No. 13/2010

- Pension Circular No. 06/2015,06/2015(1)

- Pension Circular No. 03/2020

- Pension Circular No. 03/2008(1)

Types of code numbers applied

- Widows' and orphans' pension - 23

- Widowers' and orphans' pension - 27

- Armed forces orphans' pension - 41

- Armed forces Widowers' and orphans' pension - 45

- Widows' and orphans' pension - between the age of 21-26 - 50

- Widowers' and orphans' pension - between the age of 21-26 - 51

- Widowers' and orphans' pension-below and over the age of 21 years - 53